Empowering Tech Companies to Optimize Success

Athena collaborates with driven management teams, fostering accelerated growth and maximizing business value. Our seasoned investors and operators work in synergy, ensuring exceptional returns for both our investment partners and management teams.

About Us

We look to invest after the product and market risk has been mitigated focusing on operational excellence by supporting foundational improvements, cost evaluations, enhancing organic growth and pursuing accretive acquisitions.

Athena leverages decades of experience to deliver superior returns to our investors, management teams and other stakeholders.

Pairing flexible capital, a network of experienced executives and customized operating optimization plans, we strive for Athena to be the investor of choice for enterprise software companies and technology enabled business service companies that have a sustainable competitive advantage, strong client relationships, and market-leading product capability.

Investment Criteria

Target Company Attributes

Industry

Enterprise Software and Technology-Enabled Business Services

Geography

North America

Revenue

$5m to $15m+ in ARR

Growth

Low growth or path to growth

Retention

80%+ gross annual customer retention

Profitability

Does not need to be profitable

Business Characteristics

- Significant recurring or re-occurring revenue

- Sustainable competitive technology advantage

- High switching costs

- Strong organic and inorganic growth potential

- Capital efficient

Athena Value Creation Activities

Operational Excellence

- Foundational Improvements

- Cost Evaluation

Balanced Growth

- Enhance Organic Growth

- Pursue Accretive Acquisitions

Athena uses a disciplined and distinct thematic approach to proactively identify industry sectors of interest, source initial targets for investment and accretive acquisition for our portfolio companies.

We strategically based on our decades of experience, deep industry expertise and extensive research select the most attractive domains from analysis of broader domain lists.

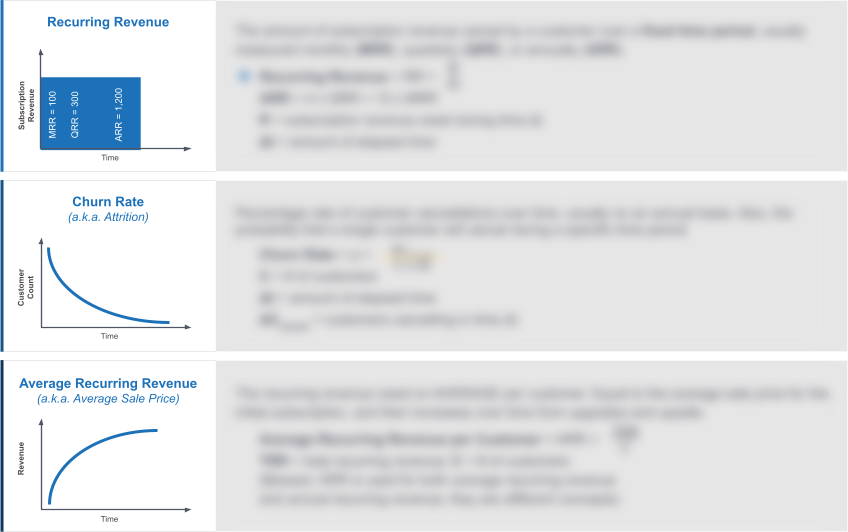

Athena applies best in class bespoke KPI analysis and benchmarking to only invest in the most promising target companies and to maximize operational excellence.

Select Key Operational & Financial Metrics